Have you ever traded without proper risk management?

If you have, you aren’t alone. Many are a victim of that ploy too. When you are starting out, you don’t know how to manage your trade risk effectively.

You just go all-gun-blazing and get wiped out in the process. It’s like sky-diving without a parachute.

If we tell you there is a magical tool that can manage your risk so effectively, you don’t have to worry about trading risk anymore.

Hear me out and stick to the guide till the end, and you’ll know why this tool is so effective.

1. Introduction

We all know forex trading is risky. No one can escape the Freddy Kruger hands of forex. But with proper risk management, you can limit the risk.

Risk management is about keeping those greens (capital) in your account while maximizing your returns. It requires a trading plan, discipline, and the right set of tools.

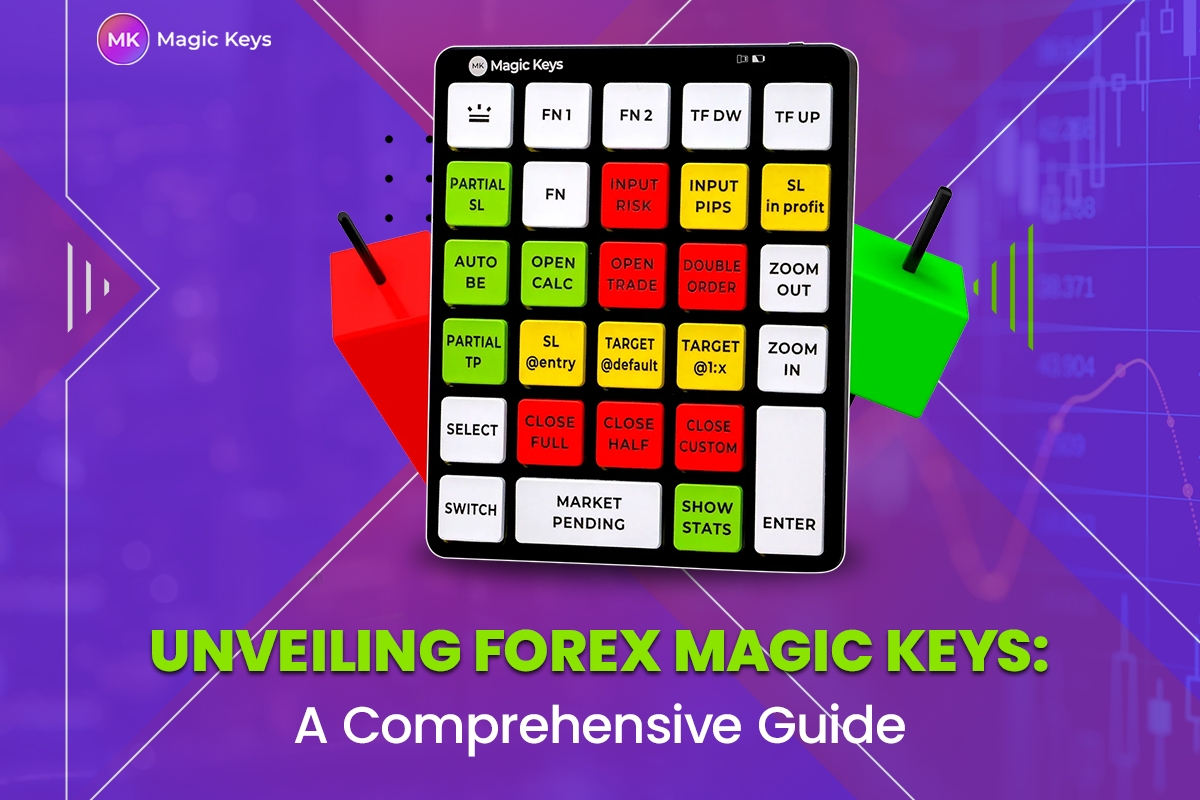

That’s when Magic Keys come into the equation. By providing a plethora of risk management features, it acts as a catalyst and limits your risk exposure.

These features include:

- Instant risk calculation

- Automatic breakeven price

- Partial stop-loss

- Multiple take-profit

- Tailing stop

As we’ll go deeper into the guide, we’ll explore all these features.

2. Strategies for Harmonizing Forex Risk Management and Magic Keys

Forex risk management with Magic Keys is a complete strategy that you need to adapt to survive the harsh forex climate.

We want to tell you how you can integrate Forex Magic Keys into your strategy for risk management.

- The first way to do that is to calculate your risk appetite. You can calculate your risk appetite with a lot size calculator. Fun fact: Forex Magic Keys is actually a lot size calculator that has a whole bunch of additional risk management features. Isn’t it cool?

- Before taking your trade, you can use instant risk calculation to determine you risk/reward ratio for every trade.

- As the trade continues, you can set automatic breakeven prices and multiple take-profit to lock in profits and limit your risk.

- In addition, you can use partial stop-loss options to manage your risk. What more can you ask for?

- Oh, we almost forgot; you can also execute trades with the Forex Magic Keys. You can use its fast pending feature to place stop or limit orders. It ensures you get the best price at optimal levels.

The best thing is the tool comes in physical and digital versions. Also, it is compatible with MT4, MT5, and cTrader.

So, if you want to integrate Forex Magic Keys as part of trading risk management, you can do that.

You can check both versions here.

Forex Magic Keys physical tool

3. Leveraging Forex Magic Keys for Precise Risk Identification

While reading a question on Quora related to forex risk management, we didn’t answer him there; we wanted to mention this here, and we did understand why this guy is struggling.

As beginners, many traders struggle with risk management. You guys are fortunate that you are learning about Forex Magic Keys if you are a beginner.

The tools give you comprehensive risk management by providing you with features that are necessary for forex success.

Our trading would become much easier if we had features like instant risk calculation and setting partial stop-loss and take-profits.

Speaking about stop-loss and take-profit, let’s see how you can use the tool for placing them.

4. Using Magic Keys to Enhance Stop Loss and Take Profit Placement

Stop-loss and take-profit are the OGs of risk management. They let you lock in profits while keeping your losses at bay.

However, with Forex Magic Keys, you can set them more efficiently with some practical tips.

Setting dynamic stop-loss

You can set a dynamic stop-loss with the Forex Magic Keys. Once you identify the analysis, you can set dynamic stop-loss and move with the trade. It ensures that you don’t get stopped out because of changing market volatility.

Placing trailing stop

The trailing stop feature allows you to lock in profits, so you don’t get completely stopped out. With Forex Magic Keys, you can set a trailing stop, and as the price moves, the trailing stop will get hit, ensuring you make some, if not all, of the profits.

Setting take-profit

Now, MT4, MT, and cTrader don’t have an option for setting multiple take-profits. Instead of aiming for a single level, you can place multiple take-profits and reap the full fruits of the trade.

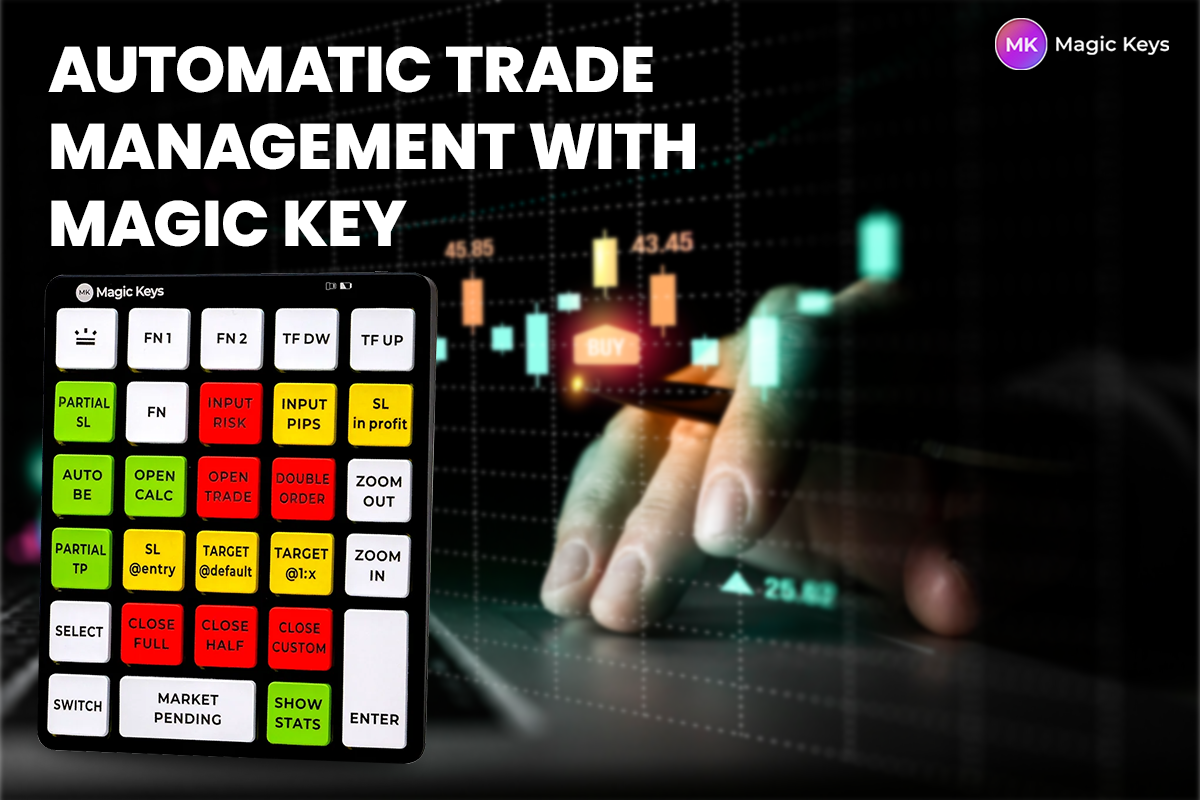

Forex Magic Keys display

5. Magic Keys as a Tool for Dynamic Lot Size Calculation in Risk Management

As we said Forex Magic Keys is a lot size calculator with cool additional features. So, how can you use the tool to calculate lot size automatically based on your risk appetite?

Firstly, with instant risk calculation, you can find out the overall risk for a trade. You just have to input an entry price, stop-loss, account size, and voila; the tool will give you the appropriate lot size.

Secondly, you also have the option to set customizable risk parameters. Forex Magic Keys will help you, whether you want a fixed amount or a certain percentage risk.

Truly, forex risk management with Magic Keys is amazing!

6. Achieving Diversification Goals through Magic Keys in Forex Risk Management

You probably heard about the trading adage, “Never put all your eggs in one basket.”

Diversification is probably the best approach for risk management. However, with Forex Magic Keys, diversification becomes a lot cooler.

Position sizing

Position sizing means the size of a trading position within your portfolio. You need to use position sizing to know how many units of forex pair you can trade according to your account.

The cool thing is that you can implement position sizing using Forex Magic Keys to diversify your capital across trading positions.

You can assign large position sizes to major pairs like EUR/USD, and GBP/USD and take small position sizes in forex minors like EUR/GBP, GBP/JPY, etc. or exotics like USD/TRY, USD/MXN etc.

Position Sizing chart

Performance analysis

Using the Forex Magic Keys’ statistical tool, you can monitor your account performance. Yes, the tool can give you statistics based on your past performance.

At this moment, we have one sentence for you:

You can look at the stats from the past and diversify your account accordingly.

7. Insights into Leverage Management with the Assistance of Magic Keys

When talking about forex risk management with Magic Keys, another key concept is leverage. Leverage is money you borrow from your broker to open larger positions. It comes in ratios like 1:10, 1:50, 1:100, and more.

Leverage is a double-edged sword. It can allow you to open larger positions, but it can also wipe your account. The larger the leverage size, the riskier it gets.

So, how does Forex Magic Keys come into play?

By inputting parameters such as margin requirements and position size, you can determine the leverage you need for your account.

Also, you can assess the risk margin calls by understanding the relationship between leverage and position sizing. They are the calls you get when your account equity falls below the broker’s required amount.

8. Analyzing Risk-to-Reward Ratios with Magic Keys for Informed Trading

Aah, the good ol’ risk-to-reward ratio. It is defined as the potential profit to the risk per trade. When you have a favorable risk/reward ratio, it suggests that the reward on this trade is better than the risk.

For instance, if you have a risk/reward ratio of 1:2, you are getting more than what you are willing to risk. You don’t download other tools to find this ratio when you have Forex Magic Keys cool features.

With the breakeven price feature, you can make sure that when the trade moves in your favor, the initial risk is limited. So, you may get a risk/reward ratio of 1:3 or 1: depending on market conditions.

In addition, with the partial stop-loss and multiple take-profit options, your risk-to-reward ratio remains balanced.

9. Building a Comprehensive Forex Risk Management Plan with Magic Keys

We have come a long way in defining forex risk management with Magic Keys. So, far, we have touched on plenty of cool things about Forex Magic Keys.

Here, I want to give you a detailed plan for using the Magic Keys. Print out the list and paste it on your trading desk if you have to, as this list will make things much easier for you.

First, determine your trading style. Find out whether you are a day trader or a long-term trader. This is because each trading style has different risk management requirements.

Next, you need to find out your risk appetite. You can consider account size, trading experience, and emotional management factors.

Identify risk management goals. Things like position sizing, leverage, risk-reward ratio, and diversification should be on the goal list.

Integrate Magic Keys features like instant risk calculation, breakeven prices, stop-loss, and multiple take-profits to manage your risk effectively.

Remember to practice discipline when applying forex risk management with Magic Keys. No amount of rules helps when you trade with emotions.

10. Conclusion

At the start, we asked you to stick with us till the end. We hope you learned why Forex Magic Keys is such an important tool in risk management.

It is not any lot size calculator you see. It gives you risk management features like breakeven prices, partial stop-loss, multiple take-profits, trailing stop, and others. You can’t find such features with any lot size calculator.

If you are curious about getting your hands on Forex Magic Keys, you can get it here.