Have you ever placed a trade and it went in the opposite direction, and you closed the trade in panic?

If you have, there’s a solution called the stop-loss with Magic Keys.

So, let’s look at how you can master stop-loss with Magic Keys.

1. Introduction

A stop-loss is the OG of risk management. It helps mitigate trade risks and protect your capital. Without a proper stop-loss in place, your account will go down as fast as a flash.

For example, if you enter a EUR/USD long trade at 1.10 and put a stop-loss at 1.0980, if it gets hit, you won’t suffer losses if the price goes below 1.0979.

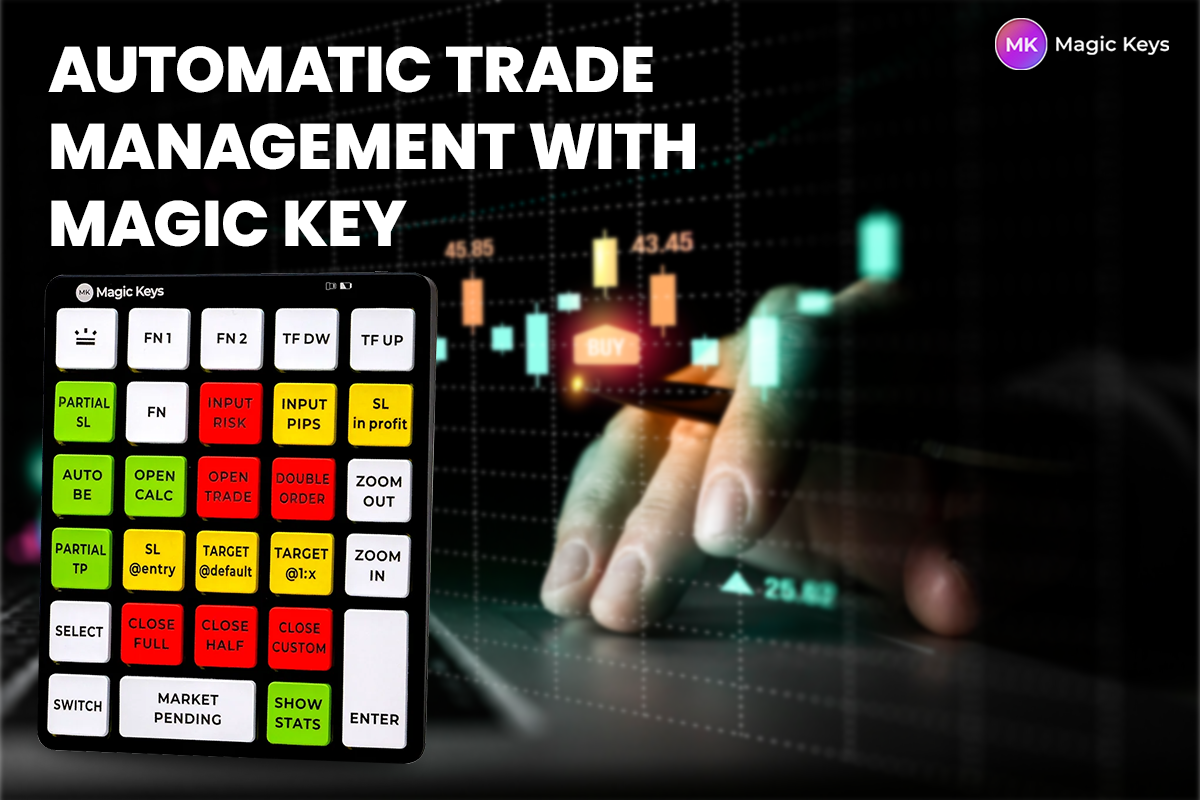

So, simple stop-loss is great, but what if you can add magic to it? We are talking about Magic Keys. It is a lot size calculator with many risk management features that kick trading losses out of the park.

It offers several stop-loss features, like setting partial stop-loss, moving stop-loss, and placing a trailing stop-loss. Truly, stop-loss with Magic Keys is a match made in heaven.

If you want to get your hands on Magic Keys, you can buy it here. Plus, you will get 20% off for a limited time. So, grab it while it is available.

Magic Keys digital version

2. Strategies for Effective Stop Loss Management with Magic Keys

Let’s cut to the chase and talk about some effective strategies you can apply for stop-loss with Magic Keys.

Percentage-based stop-loss

You can set a stop-loss according to the account’s percentage. All you have to do is do an instant risk calculation through Magic Keys and it’ll calculate the stop-loss based on the account’s percentage.

Multiple partial stop-loss

Wouldn’t it be great if you could multiple stop-losses to limit risk exposure as the price moves against you? With Magic Keys, you can set multiple partial stop-losses to get out of trades without significant losses.

Volatility-based stop-loss

You can also set volatility-based stop-loss using volatility indicators like the Bollinger Band and ATR (Average True Range). First, you can do analysis by using these indicators. Then, you can place a stop-loss with Magic Keys according to market conditions.

Trail stop to the previous candle’s high or low

With the standard trail stop, you have to set specific points from the entry point. However, with Magic Keys, you can set a trailing stop to the previous candle’s high or low. This feature allows you to adjust the stop-loss based on the previous candle, limiting the downside risks.

These strategies are super helpful when we talk about the risk/reward ratio. If you can set stop-losses at the proper place according to Magic Keys, you don’t lose more and it doesn’t break the 1:2 standard risk/reward ratio.

3. Setting Dynamic Stop Loss Using Magic Keys in Forex Trading

If you are confused about dynamic stop-loss, don’t be! The dynamic stop-loss moves with the market conditions and adjusts the place of stop-loss.

Here’s a step-by-step guide on how you can place a dynamic stop-loss with Magic Keys:

- Access the Magic Keys tool. You can get the physical and the digital version.

- After that, enter the trade and push a stop-loss button on Magic Keys. There are multiple dynamic stop-loss features, like partial stop-loss, stop-loss @entry, and stop-loss in profit. Select the option you choose suitably and place the order. That’s it, you have successfully placed a dynamic stop-loss.

Stop-loss with Magic Keys

4. Role of Magic Keys in Automated Stop Loss Placement

We have good news for those who want to apply stop-loss with Magic Keys in automated trading. Magic Keys offers plenty of automated features that can make life a hell of a lot easier. Here’s how:

- With Magic Key’s instant risk calculation, you can calculate the risk for each trade.

- As we described above, you can also set dynamic stop-losses with Magic Keys. So, automated systems can adjust dynamic stop-loss.

- Depending on your automated trading strategy, you can also set a trailing stop-loss with Magic Keys to make sure you lock in profits if the trade goes south.

5. Backtesting Stop Loss Strategies with Magic Keys for Consistency

Backtesting is an important component of any strategy, and when we are talking about stop-losses, we have to be extra careful. We don’t want to bite more than we can chew.

Backtesting allows you to look into how your stop-loss would have performed in the past. You can gather insights and refine your trading strategies.

But doing manual backtesting on MT4, MT5 or cTrader can eat up a lot of time. So, by using Magic Keys, you can make the backtesting process simpler. You can use features like stop-loss adjustment, and trailing stop to analyze strategies and adjust accordingly.

6. Customizing Magic Keys for Tailored Stop Loss Approaches

So far, we have learned how you can place stop-loss with Magic Keys. But what can you do if you want a customized experience with Magic Keys for placing stop-losses?

You can create a tailored stop-loss strategy by following a few simple steps. These include:

- First, you have to define your trading style. Are you a day trader, scalper, or a swing trader? You can adjust your stop-loss strategies according to your preferred style by answering these questions.

- Next, you have to understand your risk appetite. What’s your risk/reward ratio? Are you willing to set a risk/reward ratio of 1:2 or 1:3? Fortunately, Magic Keys's instant risk calculation can help you decide your risk appetite.

- After that, choose a stop-loss strategy. We have mentioned stop-loss strategies above, you can select any of them.

- Then, you can set stop-loss with Magic Key’s features like partial stop-loss, trailing stop or stop-loss @entry.

- You can always backtest your strategies to refine them and align them with your trading style.

7. Leveraging Magic Keys to Identify Optimal Stop Loss Levels

You can't cut losses unless you are a superhuman unless you place a stop-loss. But the question is, how can you find the optimal places to put a stop-loss?

Why not use the Magic Keys?

You can combine technical analysis with the Magic Keys to identify optimal stop-loss levels. Here’s how:

First, you need to find support and resistance levels or use indicators like Bollinger Bands or the RSI. After analyzing the market, you can set stop-loss levels according to the instant risk calculation feature of Magic Keys.

But that’s not it!

You can place multiple trialing stops in the Magic Keys feature to adjust the trade along the way and also to lock in profits.

Pro Tip: You can adjust stop-loss according to timeframe analysis. You can locate the overall trend on longer timeframes, and then return to a shorter timeframe to place a stop-loss with Magic Keys.

For instance, if you are a day trader, you can look at the overall trend on the daily or weekly chart, and then come back to an hourly chart to place a stop-loss with Magic Keys.

Magic Keys physical device

8. Real-world Examples of Successful Stop Loss Implementation with Magic Keys

If you are looking to buy Magic Keys why not see real-life examples of people who used the tool and find it super helpful for stop-loss?

Abdimalik Abdullahi E. says “It's absolutely a game changer without think the volume or the time takes to calculate it's saved and the master king of risk management with only one click.”

Karl B. said, “Magic Keys has made very precise sniper entries possible for me which gives me extreme confidence when I am trading. It has taken my trading to another level and I look forward to gaining consistent profits with it!”

These aren’t just random reviews, they are reviews of people who made a verified purchase and sent the review after using the Magic Keys. You can look for more reviews here.

9. Ensuring Precision and Security in Stop Loss with Magic Keys

Magic Keys is a great tool, but we understand your concerns regarding security and precision. You can follow certain steps to mitigate these concerns:

- You can backtest to refine your strategies with Magic Keys. This can give you a complete picture of what improvements you need to make your strategy precise.

- You can automatically set your stop-loss using Magic Keys to ensure your strategy is precise according to market conditions.

- For security, you can use redundancy measures like placing a stop-loss at multiple levels with Magic Keys, so you don’t get wiped out because of failed orders or price spikes during news events.

10. Conclusion

So, there you go! We talked about how you can place a stop-loss with Magic Keys and limit your trading risk.

Don’t get it wrong; normal stop-losses are good, but they become great with Magic Keys. The tool offers advanced stop-loss features unavailable on MT4, MT5, or cTrader platforms.

If you want to buy the tool, follow the link here, and get a 20% discount.